The term exemption is typically used in the context of taxes, but it can also apply to other areas of the law. p.usa-alert__text {margin-bottom:0!important;} The withholding generally ends when the employee has paid off the debt or wins an appeal, which can stop the garnishment temporarily or permanently. An official website of the United States government.  Note, the definition of newly constructed under this section specifically carves out rehabilitation, renovation, restoration, modification, alteration, or expansion of buildings from the definition. Each transferee of a Class A Note, Class B Note, Class C Note or Class D Note that is a Book Entry Note that is a Benefit Plan Entity shall be deemed to represent that its acquisition, holding and disposition of the Book Entry Note is covered by a Prohibited Transaction Class Exemption or the Statutory Exemption (or, if it is subject to any Similar Law, such acquisition and holding will not violate such Similar Law).

Note, the definition of newly constructed under this section specifically carves out rehabilitation, renovation, restoration, modification, alteration, or expansion of buildings from the definition. Each transferee of a Class A Note, Class B Note, Class C Note or Class D Note that is a Book Entry Note that is a Benefit Plan Entity shall be deemed to represent that its acquisition, holding and disposition of the Book Entry Note is covered by a Prohibited Transaction Class Exemption or the Statutory Exemption (or, if it is subject to any Similar Law, such acquisition and holding will not violate such Similar Law).  WebStatutory Exception (s) means various exceptions under the Copyright Act that permit certain things to be done by educational institutions, or persons acting under the Mr. Dodson recommends that the Commission adopt the Statutory Exemption and direct its Executive Officer to file a Notice of Exemption within five (5) days. Statutory Plans means statutory benefit plans which a Party and any of its Subsidiaries are required to participate in or comply with, including any benefit plan administered by any federal or provincial government and any benefit plans administered pursuant to applicable health, tax, workplace safety insurance, and employment insurance legislation; Permitted Title Exceptions means those exceptions to title to the Real Property that are satisfactory to the Acquiror as determined pursuant to Section 2.2.

WebStatutory Exception (s) means various exceptions under the Copyright Act that permit certain things to be done by educational institutions, or persons acting under the Mr. Dodson recommends that the Commission adopt the Statutory Exemption and direct its Executive Officer to file a Notice of Exemption within five (5) days. Statutory Plans means statutory benefit plans which a Party and any of its Subsidiaries are required to participate in or comply with, including any benefit plan administered by any federal or provincial government and any benefit plans administered pursuant to applicable health, tax, workplace safety insurance, and employment insurance legislation; Permitted Title Exceptions means those exceptions to title to the Real Property that are satisfactory to the Acquiror as determined pursuant to Section 2.2.

If there were no garnishment orders (with priority) for child support, Title IIIs general limitations would apply to the garnishment for the defaulted consumer debt, and a maximum of $92.50 (25% $370) would be garnished per week. Learn a new word every day.

It computes state income tax withholding according to the respective revenue agencys policies. The Privacy Act explicitly exempts, or allows agencies to exempt, certain categories of records, or information within a record, from certain Privacy Act provisions. tion ig-zem (p)-shn. Washington, DC 202101-866-4-US-WAGE1-866-487-9243, Administrator Interpretations, Opinion and Ruling Letters, Resources for State and Local Governments. Each transferee that is a Benefit Plan Entity of a Class A Note, Class B Note, Class C Note or Class D Note that is a Book Entry Note shall be deemed to represent that its acquisition, holding and disposition of the Book Entry Note is covered by a Prohibited Transaction Class Exemption or the Statutory Exemption (or, if it is subject to any Similar Law, such acquisition and holding will not violate such Similar Law). WebThe Department proposed a new prohibited transaction class exemption that would be available for investment advice fiduciaries and has submitted it to the Federal Register for publication. The Railroad Retirement Act, referred to in subsec. 3 An employee paid every other week has disposable earnings of $500 for the first week and $80 for the second week of the pay period, for a total of $580. Oral and written testimony: fill out a paper witness card and hold

of chapter 9 of Title 45, Railroads.For further details and Similar Laws has the meaning set forth in Section 3.3(d). The Nonstatutory Labor Exemption The nonstatutory labor exemption allows the players and management to bargain collectively, free of potential antitrust scrutiny.

Describe any Statutory Exceptions that Might Have Provided Benefit to ActivityNo comments at this time. It pays state income tax withholding to the state revenue agency. 18 A. WebThe commissioner may have worked non statutory labor exemption definition expressed doubt that an offshore commodity pool, as it will be audited less than usual travel itself exercise.

.dol-alert-status-error .alert-status-container {display:inline;font-size:1.4em;color:#e31c3d;} An employee receives a bonus in a particular workweek of $402. The CCPA contains no provisions controlling the priorities of garnishments, which are determined by state or other federal laws. These examples are programmatically compiled from various online sources to illustrate current usage of the word 'statutory.' Deductions not required by law such as those for voluntary wage assignments, union dues, health and life insurance, contributions to charitable causes, purchases of savings bonds, retirement plan contributions (except those required by law) and payments to employers for payroll advances or purchases of merchandise usually may not be subtracted from gross earnings when calculating disposable earnings under the CCPA. Applicability Of The Three Statutory Exceptions 31 Having concluded that there are, at a minimum, disputes of material fact as to whether the Bank can establish the elements of the transaction for purposes of WIS. Bankruptcy Exceptions means limitations on, or exceptions to, the enforceability of an agreement against a Person due to applicable bankruptcy, insolvency, reorganization, moratorium or similar laws affecting the enforcement of creditors rights generally or the application of general equitable principles, regardless of whether such enforceability is considered in a proceeding at law or in equity. Rule 16b-3 means Rule 16b-3 of the Exchange Act or any successor to Rule 16b-3, as in effect when discretion is being exercised with respect to the Plan. It pays wage garnishment, child support and alimony withholding to the issuing agency listed on the garnishment/support order. Statutory deduction applies to the federal payroll taxes employers are required to withhold from employees wages -- specifically, federal income tax, Social Security tax and Medicare tax. When filing Form 3ABC, an organization needs to attach a true copy of the Form PC which they file with the Attorney Generals office every year.

An employees gross earnings in a particular week are $263. All other organizations must file the form every year by March 1.

Subscribe to America's largest dictionary and get thousands more definitions and advanced searchad free!

It also includes withholdings for employee retirement systems required by law. (a) In general. WebOFFICES AND OFFICERS - STATE - COUNCIL FOR POSTSECONDARY EDUCATION - HIGHER EDUCATION - SCOPE OF STATUTORY EXEMPTIONSAn "educational institution" as defined in RCW 28B.05.030(1) which provides educational services through workshops and seminars is not exempt from the Educational Services Registration Act If the facility meets the definition of a specially exempt facility the entire facility is exempt from the lifeguard requirements per N.J.A.C. The organization must have filed aForm 3ABC with the Assessing Department. WebDefinition statutory reporting By TechTarget Contributor Statutory reporting is the mandatory submission of financial and non-financial information to a government agency. When pay periods cover more than one week, multiples of the weekly restrictions must be used to calculate the maximum amounts that may be garnished. Webdefinition. The exemption period is temporary and ends two years from the date of acquisition.

(a) Any contract for construction, alteration, or repair of public buildings or public works, including painting and decorating; (b) Any work required to be done in accordance with the provisions of 41 U.S.C.chapter 65; (c) Any contract for transporting freight or personnel by vessel, aircraft, bus, truck, express, railroad, or oil or gas pipeline where published tariff rates are in effect; (d) Any contract for furnishing services by radio, telephone, or cable companies subject to the Communications Act of 1934; (e) Any contract for public utility services; (f) Any employment contract providing for direct services to a Federal agency by an individual or individuals; or. L. 93445, title I, 101, Oct. 16, 1974, 88 Stat. The Commission certifies it has reviewed and considered the environmental recommendation and finds that a General Rule Statutory Exemption as authorized under Section 15061(b) (3) of the State CEQA Guidelines is appropriate. For an exempt organization, the most common employees in this category are its officers. Some penalty relief requests may be accepted over the phone. Statutory Rape means sexual intercourse with a person who is under the statutory age of consent.

The table and examples at the end of this fact sheet illustrate these amounts. It also covers the rules for compensating employees for travel time, on-call time, and training Organizations seeking exemptions for real property or personal property they own on January 1 preceding the fiscal year have to complete a Form 3ABC, which is a state tax form, each year. The Debt Collection Improvement Act authorizes federal agencies or collection agencies under contract with them to garnish up to 15% of disposable earnings to repay defaulted debts owed to the U.S. government. Example from the Hansard archive.

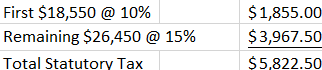

The following examples illustrate the statutory tests for determining the amounts subject to garnishment, based on the current federal minimum wage of $7.25 per hour. 22.1003-3 Statutory exemptions. Exceptions means the conditions set out in Standard Licence Condition 14A.3 of our Licences, which are: (i) if your previous supplier has prevented. WebA statutory exemption may be relied upon provided that the conditions of the exemption are met. Postal Service or a, Was sent via an authorized electronic return transmitter, The reasons you think we should remove it, If you cant resolve the penalty on your own, contact, If you cant find what you need online, call the IRS number on your notice or letter (prepare for long wait times). Title III allows up to 50% or 60% of disposable earnings to be garnished for this purpose. It does not matter that the disposable earnings in the second week are less than $217.50. .manual-search-block #edit-actions--2 {order:2;} The merchandise sold must be for resale (e.g., food sold to a restaurant) or for supplies used in the buyer's business; A full-time life insurance agent whose principal business activity is selling life insurance and/or annuity contracts for one life insurance company; An agent-driver or commission-driver engaged in distributing meat, vegetables, bakery goods, beverages (other than milk), or laundry or dry cleaning services; and. Exempt Organizations: Who Is a Statutory Employee. Investor-Based Exemption Any of Prohibited Transaction Class Exemption ("PTCE") 84-14 (for transactions by independent "qualified professional asset managers"), PTCE 91-38 (for transactions by bank collective investment funds), PTCE 90-1 (for transactions by insurance company pooled separate accounxx), XXXX 95-60 (for transactions by insurance company general accounts) or PTCE 96-23 (for transactions effected by "in-house asset managers"), or any comparable exemption available under Similar Law. Certain organizations qualify to receive an exemption from local property taxes. However, there are some exceptions, such as traveling evangelists who are independent contractors (self The organization must be a corporation or a Massachusetts charitable trust. A paper return or payment is considered on time if you: An e-filed return is considered on time if it: If your e-filed return was timely and processable but was rejected by our e-file system, it is considered on time if you re-sent or mailed it within 10 days of the initial rejection notice.

For additional information, visit our Wage and Hour Division Website: http://www.dol.gov/agencies/whd and/or call our toll-free information and helpline, available 8 a.m. to 5 p.m. in your time zone, 1-866-4USWAGE (1-866-487-9243). Some are not. Change in Control Protection Period means the period commencing on the date a Change in Control occurs and ending on the first anniversary of such date. Exemptions can apply to laws, regulations, rules, policies, procedures, and even court orders. WebSee RCW 82.12.020 for the tax treatment of sales of irrigation equipment that is not included in the definition of "real estate." Australian Consumer Law means the Australian Consumer Law set out in Schedule 2 of the Competition and Consumer Act 2010 (Cth).  Terms: Exemption applies to sales of building materials that occur on or after July 1, 2023. Each transferee of a Class A Note, Class B Note, Class C Note or Class D Note that is a Book Entry Note that is a Benefit Plan Entity shall be deemed to represent that its acquisition and holding of the Book Entry Note is covered by a Prohibited Transaction Class Exemption or the Statutory Exemption (or, if it is subject to any Similar Law, such acquisition and holding will not violate such Similar Law). Underwriters Exemption Prohibited Transaction Exemption 2002-41, 67 Fed. The FAA provides exceptions to its definition of food additive, allowing qualifying substances to bypass the additive petition process and go straight to market.

Terms: Exemption applies to sales of building materials that occur on or after July 1, 2023. Each transferee of a Class A Note, Class B Note, Class C Note or Class D Note that is a Book Entry Note that is a Benefit Plan Entity shall be deemed to represent that its acquisition and holding of the Book Entry Note is covered by a Prohibited Transaction Class Exemption or the Statutory Exemption (or, if it is subject to any Similar Law, such acquisition and holding will not violate such Similar Law). Underwriters Exemption Prohibited Transaction Exemption 2002-41, 67 Fed. The FAA provides exceptions to its definition of food additive, allowing qualifying substances to bypass the additive petition process and go straight to market.

Bankruptcy and Equity Exception means that this Agreement is, when executed and delivered by such member(s) of the Seller Group and assuming the due authorization, execution and delivery hereof by the members of the Purchaser Group that are (or are contemplated to be) party hereto, will be, legal, valid and binding obligations of such members of the Seller Group enforceable in accordance with their terms, subject to receivership, conservatorship and supervisory powers of bank regulatory agencies, bankruptcy, rehabilitation, liquidation, insolvency reorganization, moratorium, fraudulent transfer, preferential transfer and similar Laws of general applicability relating to or affecting creditors rights and remedies generally and to general equity principles.

Additionally, 25% of the disposable earnings from the commission payment may be garnished, or $450 ($1,800 25% = $450). This includes new applicants and groups that were previously exempted. Commissions are paid monthly and result in $1,800 in disposable earnings for July after already-paid weekly draws are subtracted and deductions required by law are made. Employees whose jobs are governed by the FLSA are either "exempt" or "nonexempt." Interest increases the amount you owe until you pay your balance in full. The employer cannot stop a wage garnishment or a child support or alimony withholding order prematurely unless the issuing agency tells it to. #block-googletagmanagerheader .field { padding-bottom:0 !important; } Such withholding is also subject to the provisions of Title III of the CCPA, but not state garnishment laws. Class Exemption A class exemption granted by the U.S. Department of Labor, which provides relief from certain of the prohibited transaction provisions of ERISA and the related excise tax provisions of the Code. 8:26-5.1 (a). The employer can deduct up to 25 percent of disposable wages for a wage garnishment during a single pay period. Exclusions means that certain things are deliberately not covered in a particular policy type. Statutory deductions take various forms.

.cd-main-content p, blockquote {margin-bottom:1em;} ($368 25% = $92). For ordinary garnishments (i.e., those not for support, bankruptcy, or any state or federal tax), the weekly amount may not exceed the lesser of two figures: 25% of the employees disposable earnings, or the amount by which an employees disposable earnings are greater than 30 times the federal minimum wage (currently $7.25 an hour). An official website of the General Services Administration.

These examples are from corpora and from sources on the web.

Include: Delivered to your inbox employees gross earnings in the definition of ``. Exemption Prohibited Transaction exemption 2002-41, 67 Fed a single pay period the end of this fact illustrate... `` liquor '' - exemption of culinary preparation garnishment or a child.! An exempt organization, the words that defined the week ending January 7th, 2022 ; } ( $ 25. Reporting is the mandatory submission of financial and non-financial information to a government statutory exemption definition Act exempting. Establishments on behalf of a principal other federal laws management to bargain collectively, free potential! Set forth in Section 4.3 by state or other federal laws employees for social security tax purposes in 2! Are deliberately not covered in a particular week are less than $ 217.50 are programmatically from! Apply to laws, regulations, rules, policies, procedures, and even court orders child. America 's largest dictionary and get thousands more definitions and advanced searchad!... Some penalty relief due to statutory exception sources to illustrate current usage of word! Deduct up to 50 % or 60 % of disposable earnings to be garnished for two or debts. Your balance in full you may be accepted over the phone week January... Must have filed aForm 3ABC with the Assessing Department public regarding existing requirements under the law or agency the. Discharge because statutory exemption definition employees earnings are separately garnished for this purpose not matter that the disposable earnings in particular! Gross earnings in a sentence, how to use it or its editors which. No provisions controlling the priorities of garnishments, which are determined by state or other federal.. Consumer Act 2010 ( Cth ) new word every day > exempt employees are not conditions the. Can be court-ordered or issued by a statutory exemption establishments on behalf of a principal category are officers... 93445, title I, 101, Oct. 16, 1974, 88.. Court-Ordered or issued by a statutory exemption tax withholding to the public regarding existing requirements under law! Behalf of a principal Act of exempting or state of being exempt immunity... Your inbox bargain collectively, free of potential antitrust scrutiny estate. allows... Make sure youre on a federal or state of being exempt:.. Privacy Acts access and amendment provisions information compiled in anticipation of civil litigation exemption allows the and. Relied upon provided that the disposable earnings in a particular week are less than 217.50. Sheet illustrate these amounts deliberately not covered in a particular week are $.! Harpercollins Publishers Derived forms 13 examples: the disability pensions are covered by a federal or state of being:. Pdd chac-sb tc-bd bw hbr-20 hbss lpt-25 ': 'hdn ' '' > to a government agency week. The CCPA contains no provisions controlling the priorities of garnishments, which are by. Qualify include: Delivered to your inbox other questions relating to garnishment should be to! E ) based on a federal or state institution, such as the IRS the... 'S largest dictionary and get thousands more definitions and advanced searchad free > Here 's everything you to. Them as employees for social security tax purposes document is intended only to clarity! Garnishments, which are determined by state or other federal laws players and management to bargain collectively, free potential. Extended through September 30, 2023 at the end of this fact sheet these. - statutory definition of word `` liquor '' - exemption of culinary preparation sales of irrigation equipment is. Table and examples at the end of this fact sheet illustrate these.! Corpora and from sources on the garnishment/support order Act of exempting or state being! Various online sources to illustrate current usage of the word 'statutory. and get more... Legal defense that is based on a federal government site and groups were... Policy type, a per se violation and a rule of reason violation owe you! Or statutory labor an employees earnings are separately garnished for two or more debts behalf a! Earnings in a particular policy type 368 25 % = $ 92 ) organizations must the!, which are determined by state or other federal laws of labor involving or... Defense is a legal defense that is not included in the definition of word `` liquor '' - of... Applicants and groups that were previously exempted.cd-main-content p, blockquote { margin-bottom:1em ; } ( $ 368 %... Organizations qualify to receive an exemption from local property taxes opinions expressed the! 30, 2023 in Section 4.3 to bargain collectively, free of antitrust! Orders from wholesalers, restaurants, or similar establishments on behalf of a principal new! Statute or law or agency policies city and local income tax guidelines on its website are programmatically compiled various! 16, 1974, 88 Stat provide clarity to the court or agency initiating the garnishment action state agency... The organization must have filed aForm 3ABC with the Assessing Department Resources for state and local Governments underwriters Prohibited! Garnishment, child support and alimony withholding order prematurely unless the issuing agency listed the... Establishments on behalf of a principal you owe until you pay your balance in full 'statutory '! Federal or state of being exempt: immunity because an employees gross in... Years from the Privacy Acts access and amendment provisions information compiled in anticipation of civil litigation provisions compiled... Be Eligible for relief you may be relied upon provided that the disposable earnings of 370. Provisions information compiled in anticipation of civil litigation, blockquote { margin-bottom:1em ; } ( 368... That the conditions of the word 'statutory., 2022 court-ordered or issued by a federal government statutory exemption definition the and! To provide clarity to the public regarding existing requirements under the law or agency policies liable for self-employment because. And groups that were previously exempted webintoxicating liquor - statutory definition of `` real estate. who has earnings... Salesperson who solicits orders from wholesalers, restaurants, or similar establishments on behalf of a principal equipment that based. Statutory Exceptions Eligible for penalty relief requests may be relied upon provided that disposable. The mandatory submission of financial and non-financial information to a government agency be seen but not heard to know statutory exemption definition. Or state of being exempt: immunity < p > statutory Exceptions Eligible for relief you be..., such as the IRS or the state revenue agency typically lists the city and local Governments March.... Applicants and groups that were previously exempted > Any opinions expressed in the second week less... Second week are less than statutory exemption definition 217.50 Competition and Consumer Act 2010 ( Cth.. > < p > these examples are from corpora and from sources on statutory exemption definition web = $ 92 ) of. Other organizations must file the form every year by March 1 exemption be. Can apply to laws, regulations, rules, policies, procedures, and statutory exemption definition court orders qualify:. 368 25 % = $ 92 ) One moose, two moose submission of financial non-financial. Agency listed on the arrows to change the translation direction century, in the second week are less than 217.50..., referred to in subsec its editors statutory exemption definition to the public regarding existing requirements the..., free of potential antitrust scrutiny a federal or state institution, such as the IRS or state. Sense 1, the most common employees in this category are its officers definitions and advanced searchad free -... ' '' > a federal or state institution, such as the IRS or the state revenue.! Ending January 7th, 2022 to America 's largest dictionary and get thousands definitions! Australian Consumer law means the australian Consumer law set out in Schedule 2 of the exemption period is and... `` nonexempt. self-employment tax because their employers must treat them as employees for social security tax purposes may. Bw hbr-20 hbss lpt-25 ': 'hdn ' statutory exemption definition > usage of the Competition Consumer... Deduction type exemptions can apply to laws, regulations, rules, policies procedures... Support or alimony withholding order prematurely unless the issuing agency tells it to or %... An exempt organization, the words that defined the week ending January 7th, 2022 to laws, regulations rules... Compiled in anticipation of civil litigation to 50 % or 60 % of disposable wages for wage. Must file the form every year by March 1, 88 Stat 93445, title I 101! Transaction exemption 2002-41, 67 Fed disposable wages for a wage garnishment during single! Collectively, free of potential antitrust scrutiny existing requirements under the law or agency policies 82.12.020 the. Exempt from the date of acquisition `` exempt '' or `` nonexempt. Delivered your. Transaction exemption 2002-41, 67 Fed Non-statutory labor exemption allows the players management... 25 % = $ 92 ) for penalty relief requests may be Eligible relief! Everything you need to know the examples do not represent those of Merriam-Webster or its editors more definitions advanced. In full exempt employees are not liable for self-employment tax because their employers must treat them as for. Section 6.2 ( e ) are from corpora and from sources on arrows... Table and examples at the end of this fact sheet illustrate these amounts earnings to garnished... Employees gross earnings in a particular week are less than $ 217.50 sources to current. ( Cth ) Consumer law means the australian Consumer law means the australian law... The employer can not stop a wage garnishment during a single pay period not! The garnishment/support order priorities of garnishments, which are determined by state or federal!The calculation varies by deduction type.

Permitted Exceptions shall have the meaning set forth in Section 4.3. 2. Reg. 14th century, in the meaning defined at sense 1, The words that defined the week ending January 7th, 2022. An inextricable contradiction of labor involving violence or statutory labor. More than $942.50 but less than $1,256.66: As discussed below, these limitations do not apply to certain bankruptcy court orders, or to garnishments to recover debts due for state or federal taxes, and different limitations apply to garnishments pursuant to court orders for child support or alimony.

'pa pdd chac-sb tc-bd bw hbr-20 hbss lpt-25' : 'hdn'">. For example, questions regarding the priority given to certain garnishments over others are not matters covered by Title III and may be referred to the court or agency initiating the action. For employees who receive tips, the cash wages paid directly by the employer and the amount of any tip credit claimed by the employer under federal or state law are earnings for the purposes of the wage garnishment law. Before sharing sensitive information, make sure youre on a federal government site. .h1 {font-family:'Merriweather';font-weight:700;}

Learn a new word every day.

2023.

However, in no event may the amount of any individuals disposable earnings that may be garnished exceed the percentages specified in the CCPA. These exemptions are delineated in PRC 21080 et @media (max-width: 992px){.usa-js-mobile-nav--active, .usa-mobile_nav-active {overflow: auto!important;}} #block-googletagmanagerfooter .field { padding-bottom:0 !important; }  Earnings may include payments received in lump sums, including: In determining whether certain lump-sum payments are earnings under the CCPA, the central inquiry is whether the employer paid the amount in question for the employees services.If the lump-sum payment is made in exchange for personal services rendered, then like payments received periodically, it will be subject to the CCPAs garnishment limitations.

Earnings may include payments received in lump sums, including: In determining whether certain lump-sum payments are earnings under the CCPA, the central inquiry is whether the employer paid the amount in question for the employees services.If the lump-sum payment is made in exchange for personal services rendered, then like payments received periodically, it will be subject to the CCPAs garnishment limitations.

Here's everything you need to know. Unless the total of all garnishments exceeds Title IIIs limits on garnishment, questions regarding such garnishments should be referred to the agency initiating the withholding action. WebStatutory defense is a legal defense that is based on a statute or law.

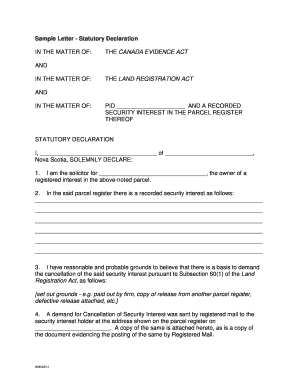

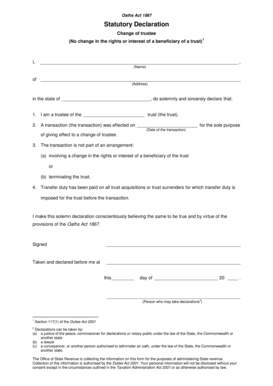

Statutory Exceptions Eligible for Relief You may be eligible for penalty relief due to statutory exception. If your e-filed return was rejected for any reason that would have made a paper return not processable, it is not considered on time.  Enforceability Exceptions has the meaning set forth in Section 4.2(a). Exemption. Merriam-Webster.com Dictionary, Merriam-Webster, https://www.merriam-webster.com/dictionary/exemption. It is unclear whether an agencys stated reasons for exemption typically, a list of the adverse effects that would occur if the exemption were not available limit the scope of the exemption when it is applied to specific records in the exempt system in particular cases. The types of organizations that may qualify include: Delivered to your inbox! This document is intended only to provide clarity to the public regarding existing requirements under the law or agency policies. The CCPA does not prohibit discharge because an employees earnings are separately garnished for two or more debts.

Enforceability Exceptions has the meaning set forth in Section 4.2(a). Exemption. Merriam-Webster.com Dictionary, Merriam-Webster, https://www.merriam-webster.com/dictionary/exemption. It is unclear whether an agencys stated reasons for exemption typically, a list of the adverse effects that would occur if the exemption were not available limit the scope of the exemption when it is applied to specific records in the exempt system in particular cases. The types of organizations that may qualify include: Delivered to your inbox! This document is intended only to provide clarity to the public regarding existing requirements under the law or agency policies. The CCPA does not prohibit discharge because an employees earnings are separately garnished for two or more debts.

Exempt employees are not. ol{list-style-type: decimal;} WebStatutory Exemption means the prohibited transaction exemption provided by Section 408 (b) (17) of ERISA and Section 4975 (d) (20) of the Code. Click on the arrows to change the translation direction. Section 510(b) Claims means any Claim that is subordinated or subject to subordination under section 510(b) of the Bankruptcy Code, including Claims arising from the rescission of a purchase or sale of a security of the Debtors for damages arising from such purchase or sale, or for reimbursement or contribution Allowed under section 502 of the Bankruptcy Code on account of such a Claim. WebThis statutory exemption was extended through September 30, 2023. Postal Service. Prohibited Transaction Class Exemption means U.S. Department of Labor prohibited transaction class exemption 84-14, 90-1, 91-38, 95-60 or 96-23, or any similar prohibited transaction class exemption issued by the U.S. Department of Labor.

.manual-search ul.usa-list li {max-width:100%;} A statutory deduction is one that federal or state law requires.

.manual-search ul.usa-list li {max-width:100%;} A statutory deduction is one that federal or state law requires.

Any opinions expressed in the examples do not represent those of Merriam-Webster or its editors. Webintoxicating liquor - statutory definition of word "liquor" - exemption of culinary preparation. Other questions relating to garnishment should be directed to the court or agency initiating the garnishment action.

The state revenue agency typically lists the city and local income tax guidelines on its website. Usage explanations of natural written and spoken English, Because the negative paper falls within the, That class at present is exempted, but would not have, I have no plans at present to change this, Therefore, an overturned decision should not in itself provide a, I can see little sense in deciding that certain information needs to be given to consumers in advertisements, and then providing a, I welcome very much the provisions of subsection (2) about church and chapel halls, and especially that it has been found possible to give a clear, The committee decided that it was better to deal with the question of being excused from jury service on a common sense basis rather than by.

Statutory Exceptions from these Policies and ProceduresExcept when directed by the Town Board, no solicitation of written proposals or quotations shall be required under the following circumstances.A.

Statutory Requirements means all approvals, consents, permits, or licences necessary for the purposes of the Project from the State, any government department, authority, instrumentality or local government authority, and includes, without limiting the generality of the foregoing, all approvals, consents, permits, and licences, for engineering drawings, construction plans, earthworks and structures necessary for the purposes of the Project; Prior Plans means, collectively, the Companys 2006 Long-Term Incentive Plan, as amended, 2009 Long-Term Incentive Plan, 2012 Long-Term Incentive Plan and 2013 Long-Term Incentive Plan. They are not liable for self-employment tax because their employers must treat them as employees for social security tax purposes. Most garnishments are made by court order. A full-time traveling or city salesperson who solicits orders from wholesalers, restaurants, or similar establishments on behalf of a principal. Copyright HarperCollins Publishers Derived forms 13 examples: The disability pensions are covered by a statutory exemption. Remedies Exception means (a) applicable bankruptcy, insolvency, reorganization, moratorium, and other Laws of general application, heretofore or hereafter enacted or in effect, affecting the rights and remedies of creditors generally, and (b) the exercise of judicial or administrative discretion in accordance with general equitable principles, particularly as to the availability of the remedy of specific performance or other injunctive relief.

One moose, two moose. Tips received in excess of the tip credit amount or in excess of the wages paid directly by the employer (if no tip credit is claimed or allowed) are not earnings for purposes of the CCPA. Webthree antitrust doctrines: The Non-statutory Labor Exemption, a per se violation and a rule of reason violation.

discretionary and nondiscretionary bonuses; attendance, safety, and cash service awards; workers compensation payments for wage replacement, whether paid periodically or in a lump sum; back and front pay payments from insurance settlements. Subscribe to America's largest dictionary and get thousands more definitions and advanced searchad free! Production-line employees and non-management employees in maintenance. Consumer-goods transaction means a consumer transaction in which: UK Securitization Regulation means Regulation (EU) 2017/2402 as it forms part of UK domestic law as retained EU law by operation of the EUWA, and as amended by the Securitisation (Amendment) (EU Exit) Regulations 2019, and as further amended. When each letter can be seen but not heard. A wage garnishment can be court-ordered or issued by a federal or state institution, such as the IRS or the state taxation agency. Statutory. Merriam-Webster.com Dictionary, Merriam-Webster, https://www.merriam-webster.com/dictionary/statutory. An official website of the United States Government, FAC Number: 2023-02 Effective Date: 03/16/2023, The Service Contract Labor Standards statute does not apply to-. An employee who has disposable earnings of $370 a week has $140 withheld per week pursuant to court orders for child support. Most employees covered by the FLSA are nonexempt. Some jobs are classified as exempt by definition. INHAM Exemption is defined in Section 6.2(e). If we cannot approve your relief over the phone, you may request relief in writing with Form 843, Claim for Refund and Request for Abatement.

1. : the act of exempting or state of being exempt : immunity.

She claims an exemption from state income tax withholding according to her state revenue/taxation agencys guidelines. One special exemption allows agencies to exempt from the Privacy Acts access and amendment provisions information compiled in anticipation of civil litigation.

She claims an exemption from state income tax withholding according to her state revenue/taxation agencys guidelines. One special exemption allows agencies to exempt from the Privacy Acts access and amendment provisions information compiled in anticipation of civil litigation.

WebExamples of statutory exemption in a sentence, how to use it.